However, if you decide to use the actual expense method, you have to stand by that choice until you retire the car. If you start with the standard method, you can switch to the actual expense method whenever you like. For example, if you have a car you use for business trips 25% of the time and personal trips 75% of the time, you can only deduct 25% of your car expenses.Īlternatively, you can use a standard mileage rate issued by the IRS to calculate your deduction, which involves multiplying your miles driven for business purposes by $0.56 in 2021 and $0.585 in 2022. That said, you can only deduct the portion of your auto expenses that corresponds with your business use.

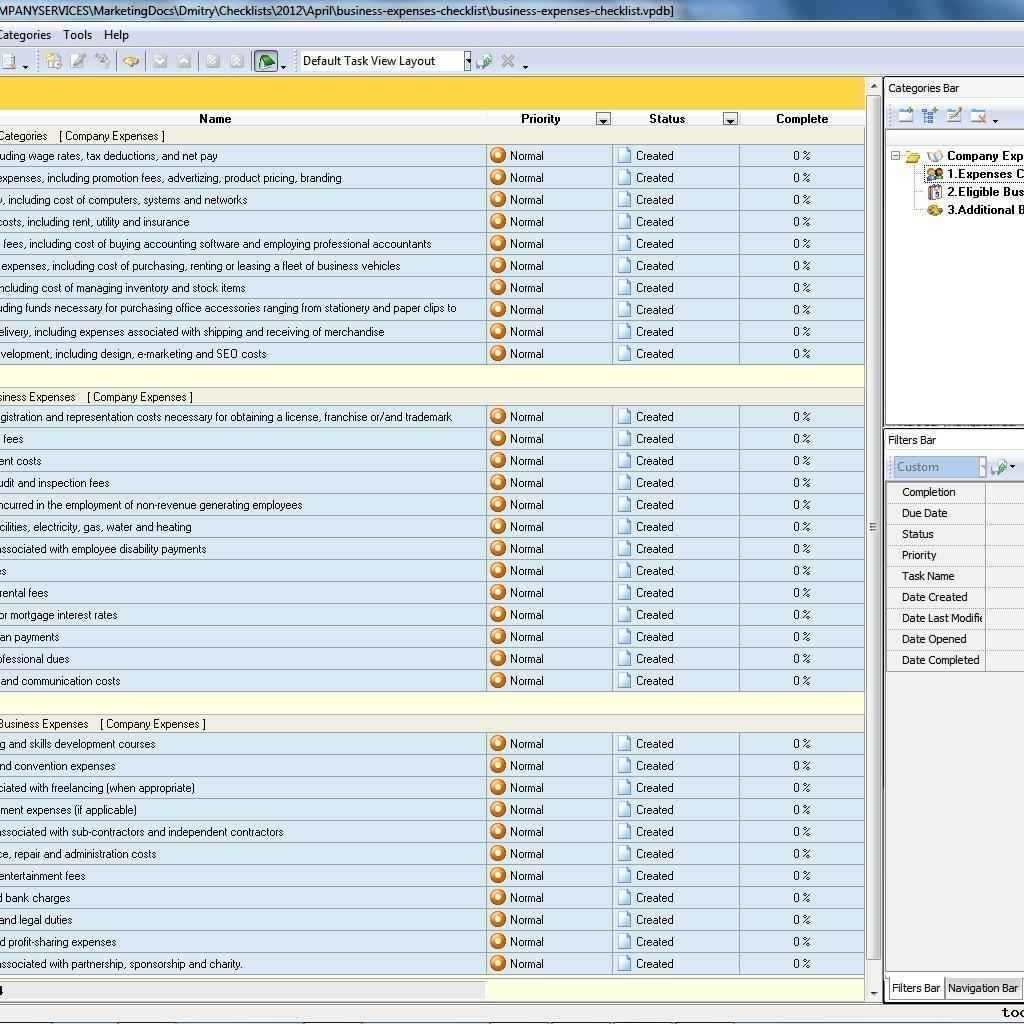

IDEPENDENT CONTRACTOR EXPENSES REGISTRATION

That typically includes things like gas, maintenance, registration fees, and auto insurance premiums. If you drive your car as part of your business, you might be able to deduct some of the expenses you incur for the vehicle. For example, you might write off the cost of your ads on social media platforms, direct mail campaigns, and business website. Unless you have a vast network of pre-existing clients or customers, that means you’ll probably have to advertise your company somehow.įortunately, you can deduct those expenses, even if they take a variety of different forms. Advertising ExpensesĪs a small business owner, you’ll need to find a way to generate interest in your product or services. If you’re unsure what those might be, here are some great ideas to get you started. That language sounds a bit stiff, but it basically means that you can deduct the expenses someone in your line of business would reasonably need to pay. However, if you’re a 1099 contractor, the Internal Revenue Service (IRS) lets you deduct all ordinary and necessary business expenses on your tax return. One downside to being a W-2 employee is that you don’t have access to many tax write-offs.

0 kommentar(er)

0 kommentar(er)